govt notification

Friday, 3 June 2016

govt notification

Sunday, 27 March 2016

The Real Estate (Regulation and Development) Bill:

The

Government plans to have, by year 2022,affordable housing for all citizens.Till

date especially in Mumbai, Pune,Bangalore, Delhi and countless other metropolis

and developing urban areas, the developers took undue advantage of the buyers

even when real estate was already pricey and

profitable, information about the builders was not dependable, and there was no

way for the consumer to have technical knowledge of construction.

The consumers in the growing real estate market face an acute

problem of information asymmetry. They don’t have adequate information about

the land itself, its ownership and other caveats. They have no way of knowing

whether the developer has all the necessary permissions in place and they have

always been cheated about the completion dates even when they end up paying on

a timely basis of “slabs”, which makes up for almost 90% of the cost of the

flat/real estate. However, banking on this information asymmetry, the developers

divert these funds to buy other projects and continue with the same procedure and

proceed for a 3rd project and so on and so forth. By this time, the consumers

of the 1st project are now in aggression over the delay so some

funds find their way back to completing this estate.The developer, even though

undertaking massive projects in this capital intensive sector, never takes a

loan or is never in need of financial assistance because he uses the consumer’s

money for rolling which is more than sufficient for him.

On the other hand, if the buyer vets the agreement, it is likely

that he will infer that all clauses are in favor of the builder and loaded

against him. For instance, a delay in payment empowers the developer to charge

you 18%p.a, while there is absolutely no mention whatsoever of any liability on

the developer to deliver the estate on time. Forget delivery, even the

completion dates are subject to numerous conditions and caveats which nullify

any legal backing to the promise of a delivery, even though it is mentioned in

the agreement. Project brochures are made by advertingprofessionals, which portray

a totally different scene from what is actually being developed. Amenities are

overstated, maintenance costs are conveniently ignored and the consumers are

misled to believe that surrounding estates will also be as pleasant as depicted

in the advertisements. Sample flats shown by the developer have class graded

amenities but in reality the ones provided on completion are cheap knock-offs.

The Developer always finds avenues to delay handing over the estate

to the society (read: housing society), primary reason being:

i. He can charge more maintenance

ii. If,FSI is increased, the developer can benefit by developing

the same estate further with a higher market price.

The Real Estate bill tries to curb these activities and help

overcome the hardship faced by buyers. The core objective of the bill is to

protect the interest of the buyers and promote fair play in real estate market.

The highlights of the Real Estate (Regulatory and Development) Bill are:-

1)

There has been no solid framework for any regulation

to set in in this sector and this bill will successfully formulate a uniform

regulatory environment for Real Estate.

2)

The Government is set to establish,first and foremost,

the Real Estate Regulatory Authority (RERA). This body will be created for the

registration of Real Estate agents and their subsequent projects. Appellate

Tribunal of Real Estate will also be devised so that the decisions of RERA

could be appealed. This will result in less pressure on the judiciary and

thereby result in faster dispute resolution through these forums.

3)

The Bill outlines the duties of developers, buyers and

agents in the Residential Real Estate sector.

4) Developers will be barred from booking or offering any Real Estate

projects of Residential(housing,condominium,town homes) Commercial (offices, warehouses)

and industrial (factories, workshops) nature for sale without registering them

in RERA. The information of the promoter would be uploaded with the details of

above mentioned point in the website of RERA.

5) To prevent diversion of funds

from the project, the bill envisages that 70% of the money paid by the

buyer should be maintained in a separate escrow bank account for the

construction of the project to cover the cost of construction, including but

not limited to, the cost of the land. The developer will be allowed to withdraw

the amount,subject to terms and conditions set in the legislation.

6) Standard model agreement will have written clauses with respect to

completion certificate and payments.

7) All measurements will be disclosed in terms of carpet area only. This

brings about uniformity. Carpet area is the area which includes usable spaces

like kitchen and toilets, and it would be clearly defined to impart clarity,

which was not the case prior to his bill. Misleading terms like super-built up

will be barred or will not have any legal backing.

8) Structural Defects: It is suggested that builders will be liable for structural

defects with imprisonment of five years which is more than the earlier

prescribed punishment of two years. “In such cases, the jail term is

that of one year or five per cent of the apartment cost or both. Other

pro-developer measures include single window clearance and digitization of land

records.” Defect liability

period for quality of construction is now 5 years.

9) The bill also brings about an increasingly regulated broker

environment.Brokers are also required to register with the Regulatory

authority.

10) At least 2/3rd of the buyers consent will be needed if

the developer wants to alter the plans,structural designs and specifications of

the building.No changes in the project plan at a later stage.

11) No Discrimination: There will be no discrimination based on caste, religion, creed,

or gender. The government may bring a non-discriminatory clause to allow anyone

to buy a property in the complex, even a transgender.

12) Resident Welfare Association: “Formation of resident welfare

association has been made compulsory

within 3 months of the allotment of the majority of the units in the

project so that buyers get to utilize facilities such as common hall, club

house, reading room”.

The main purpose of the Bill is to restore the confidence of the

people in the Real Estate zone by introducing transparency and accountability

in the housing markets.Along with guaranteeing speedy

trials of disputes and growth to the sector, “it also ensures to curb corruption and use of black money in the real estate market,

the Bill will include some provisions which will help in tracking down

innumerable sources of black money which currently costs the government Billions

of rupees in lost taxable income.”

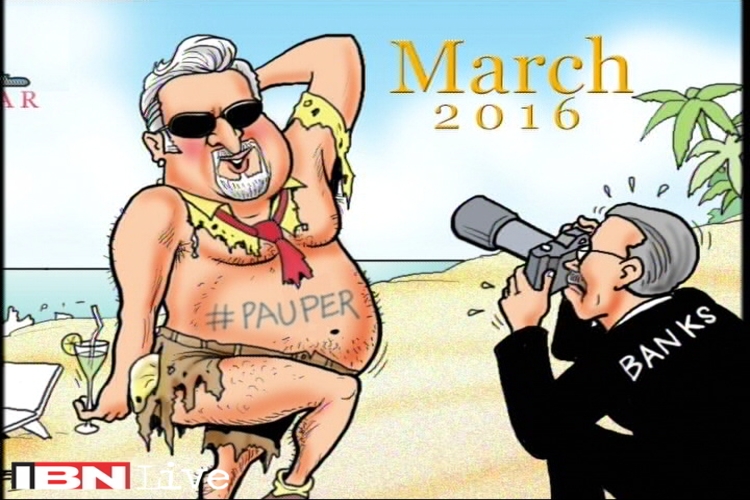

Tuesday, 15 March 2016

COLLECTIVE

FAILURE OF SYSTEM

The culture of ‘Self –enriching’,

growing rich at the cost of others, is fast catching up in India, courtesy the

politicians and the failure of systems to penalize them,thereby failing the

‘Doctrine of unjust enrichment’.

Mr Vijay Mallaya left the country, not set to return in the near

future, similar to Mr. Lalit Modi and the notorious Dawood Ibrahmin.

The systematic failure of the Banks

and the Regulatory system, in tandem with the blatant irresponsible use of the

Kingfisher conglomerate funds as the promoters personal money bank all

culminated into this massive blow up.

BANKS

a) The total amount that KFA owes to

all banks is approximately Rs. 9,000 Crores, broadly divided between the banks

as,SBI Rs. 1,600/- Crores, IDBIRs. 800/-Crores,PNB Rs. 800 Crores,BOI Rs. 650 Crores,BOB Rs.

550 Crores.

b) Consortium of 17 lenders led by SBI

had from time to time extended loans on favorable terms to KFA. Was Due

diligence properly conducted? Was credit appraisal properly done? With

individual risk of each bank being stretched by individual loans, a consortium

loan would further weaken the banks security and stretch the company’s asset

cover to its limits.

c) Every bank has a credit committee.Their

role in sanctioning huge amounts? As mentioned before, the banks had individual

credits extended to the company along with the consortium loan. This fact in

itself should have raised red flags within the banking system as it goes well

beyond the banks systematic risk.

d) Were they convinced to finance an

aircraft which they had never done in their life? Nor having knowledge of

financing aircrafts? A capital intensive industry in a competitive market built

on cash flows and working capital is massive risk in itself which requires

strenuous planning and sound crisis mitigation systems in place.

e)In the year 2009-10,the consortium

restructured their debt, even when KFA had negative net worth and was

technically categorized as an NPA. As a stakeholder, the banks should have

raised concerns and filed for creditors liquidation given the bad shape of the

company’s debts. However, restructuring the same debt was bound to fail, and

the banks had a moral duty to end the company then and there. Ignoring the

moral duty, they converted the loan into equity, that too at a premium. Rs. 1,355

Crores of debt was converted into equity at 61.6% premium of market price. In

lay man’s terms, a loan was converted into capital. Who benefited from this?

Certainly not any of the stakeholders!

f) A common element in all of the

lending’s was the reliance on the Kingfisher brand value and its (assumed)

ability to generate cash. How far can one take the reliance on ‘brand value’?

How reliable is the valuation itself. Given the bad shape of the debt in the

company and the conglomerate as a whole, shouldn’t the brand be revalued from

time to time to reflect its true value?

h) Inspite of all the aforementioned problems

the company was facing, Vijay Mallya drew a salary of almost Rs. 34 Crores. Was

there no shareholder activism or moral obligation on the any of the lenders and

Financial Institutional Investors to oppose this practice?

i) The auditors, of the Banks as well

as KFA, must have notices this bubble of loan bloating up for quite a while. In

a situation which escalated to non-payable debt of Rs. 9,000 Crores, none of

the auditors of any organizations which were a part of this transaction had

qualified any of the audit reports. Isn’t this a breach of the auditor’s

fiduciary duty?

Let us not forget that every company

here had to file its compliances regularly to regulators from every spectrum of

the economic industry. Which brings us to the next point.

REGULATORY

AUTHORITIES

The Enforcement

Directorate, RBI, Directorate of Aviation, the quasi-judicial body of DRT, the

Registrar of Companies, the Income tax authorities and ultimately the Stock

Exchange and SEBI. All of these regulatory bodies had received some form of

literature pertaining to KFA’s predicament, and yet, no suo moto action was taken. Some of the issues which these bodies

should have picked can reiterated, such as:

-

Conversion of 20%loan in to equity

when net worth was flattening.

-

Was prudential credit exposure limits

followed by banks?

-

The borrower’s inadequate credit

ratings and the Company’s eligibility. KFA’saviation license was cancelled in

the year 2012 and had not flown since then. How such a company which fails the

basic test of ‘going concern’ allowed to raise debt on a continuous basis.

-

The Labour commissioner did not take

any action in spite of salaries not paid on time.

CBI issued Look out Circular(LOC)against

Mallaya in October and changed it back in November. Why weren’t any reports

raised to question this action which was obviously on the right track? SFIO tightened

their grip on defaulting companies and the irresponsible lenders but only when

it was too late. Stakeholders expect a more pro-active intimidation from

regulatory authorities. Similarly, DRT has given adjournments a multitude of

times, which can be viewed as a failure of the judicial system. Did all the

aforementioned investigating agencies act with rectitude in the KFA case?

KFA

KFA was incorporated as a birthday

present to the son of Vijay Mallya, Siddharth Mallya, on his 18th

birthday, listing him as one of the Directors. At the inception, the airline

functioned in able hands actively killing the competition by setting up

benchmark of affordable luxury travel. However, it started going downhill soon

after. It started being used as the Mallya’s personal charter airline, which

primarily came into focus when he flew in pop star Enrique Iglesias for his 60th

Birthday, and started directing personal attacks on other airline by tweeting

about their poor service. Furthermore, the Basic principles of corporate governance

were not followed while running the company, let alone ethical standards.

He is drawing salary as Rajya Sabha Member(tax payers money) and he ran away from India on Diplomat passport.

This is not a one –off story.Such

stories get repeated with alarming regularity and yet every time the regulators

swoop in when the worst has passed. Jindal Steel & Power,Jai Prakash Associates

whose ratings have been downgraded by 2 notches in a single action, indicate

that they need to be monitored more closely.

Friday, 15 January 2016

Commercial Courts, Commercial Division and Commercial Appellate

Division of High Courts Act, 2015.

On 23 October 2015, the President of India promulgated the

Commercial Courts, Commercial Division and Commercial Appellate Division of

High Courts Ordinance, 2015.

The Ordinance provides for the constitution of Commercial Courts,

and the establishment of Commercial Divisions and Commercial Appellate

Divisions within High Courts to adjudicate ‘Commercial Disputes’.

The Ordinance amends certain provisions of the Civil Procedure

Code, 1908, to the extent applicable to ‘Commercial Disputes’ and also

prescribes timelines to streamline the conduct of such ‘Commercial Disputes’.

"Commercial Court" means the Commercial Court constituted under

sub-sec (1) of section 3,

"Commercial Appellate Division" means

the Commercial Appellate Division in a High Court constituted under sub-section

(3) of section 3;

"Commercial

dispute" means a dispute arising out of—

(i)

Ordinary transactions of merchants, bankers, financiers and

traders such as those relating to mercantile documents, including enforcement

and interpretation of such documents;

(ii)

Export or import of merchandise or services;

(iii)

Issues relating to admiralty and maritime law;

(iv)

Transactions relating to aircraft, aircraft engines, aircraft

equipment and helicopters, including sales, leasing and financing of the same;

(v)

Carriage of goods;

(vi)

Construction and infrastructure contracts, including tenders;

(vii)

Agreements relating to immovable property used exclusively in

trade or commerce;

(viii)

Franchising agreements;

(ix)

distribution and licensing agreements;

(x)

management and consultancy agreements;

(xi)

joint venture agreements;

(xii)

shareholders agreements;

(xiii)

subscription and investment agreements pertaining to the services

industry including outsourcing services and financial services;

(xiv)

mercantile agency and mercantile usage;

(xv)

partnership agreements;

(xvi)

technology development agreements;

(xvii)

intellectual property rights relating to registered and

unregistered trademarks, copyright, patent, design, domain names, geographical

indications and semiconductor integrated circuits;

(xviii) agreements

for sale of goods or provision of services;

(xix)

exploitation of oil and gas reserves or other natural resources

including electromagnetic spectrum;

(xx)

insurance and re-insurance;

(xxi)

contracts of agency relating to any of the above, or relating to

such other commercial disputes as may be prescribed; and

Wide meaning of 'Commercial Dispute': The term ‘Commercial Dispute’ has been very broadly defined in the

Ordinance, to encompass almost every kind of transaction that gives rise to a

commercial relationship. The subject matter of such disputes could be as wide

ranging as commercial contracts relating to exploitation of natural resources,

intellectual property rights, insurance, construction and infrastructure

contracts, government contracts, immovable property, etc. Such commercial

disputes will now be adjudicated by Specialized Commercial Courts which will

comprise of judges specially trained to deal with Commercial Disputes.

Specialized

Commercial Courts at various levels: These will be

categorised as follows:

(a) Commercial

Courts will be constituted in every district in all states and union

territories where the High Court of that state or union territory does not

have/exercise ordinary original civil jurisdiction. At present, only five High

Courts exercise ordinary original civil jurisdiction – the High Courts of

Delhi, Bombay, Madras, Calcutta and Himachal Pradesh. Therefore, in all other

states and union territories, Commercial Courts will now adjudicate upon

Commercial Disputes.

(b) Commercial

Divisions will be set up within High Courts which do exercise ordinary original

civil jurisdiction. A Commercial Division in such states and union territories

will exercise jurisdiction over all cases and applications relating to Commercial

Disputes.

(c) Commercial

Appellate Divisions will be set up in every High Court to hear appeals against

(i) orders of Commercial Division of High Court; and (ii) orders of Commercial

Courts. Interestingly, the Ordinance does not provide for a statutory right to

appeal to the Supreme Court from an order of the Commercial Appellate Division.

Accordingly, the Ordinance limits the number of appeals allowed in Commercial

Disputes to only one.

At present, although there are no specialized designated

commercial courts which hear Commercial Disputes, certain judges at the

district court level predominantly hear Commercial Disputes. Similarly, in the

five High Courts which exercise ordinary original civil jurisdiction in India,

there are designated judges who hear Commercial Disputes. Such designated

judges at the district court level and the High Court level, however, do not

hear commercial matters exclusively. The Ordinance proposes to constitute and

establish Specialized Commercial Courts to hear only Commercial Disputes.

Commercial

Dispute value threshold: Under the

Ordinance, only those Commercial Disputes where the value of the subject matter

in respect of the said Commercial Dispute is more than Rs 1,00,00,000 (defined

as Specified Value in the Ordinance), will be adjudicated by the Specialized

Commercial Courts. Further, the Ordinance has also prescribed the manner in

which the Specified Value of a commercial dispute is to be determined.

Given that the objective of the Ordinance is to fast track the

resolution of Commercial Disputes, the threshold of Rs. 1,00,00,000 can be

considered to be low. As a result, larger Commercial Disputes may not receive

the focus that may have been intended through the Ordinance.

Existing

Commercial Disputes to be transferred: Under the

Ordinance, all suits and/or applications relating to a Commercial Dispute of a

Specified Value pending before any civil court where a Commercial Court has

been constituted will be transferred to such Commercial Court. Similarly, where

a Commercial Division has been constituted (in the five High Courts exercising

ordinary original civil jurisdiction), such pending suits and applications will

be transferred to the new Commercial Divisions of such High Courts.

Jurisdiction

over arbitrations: In line with

the terms of the arbitration ordinance, all matters pertaining to international

commercial arbitrations have been brought within the purview of the High Court,

whether or not such High Court exercises original jurisdiction [1], except

matters relating to the appointment of arbitrators in international commercial

arbitrations[2].

Applications and appeals arising out of domestic arbitrations

involving purely local Indian parties, which would ordinarily lie before any

principal civil court of original jurisdiction (not being a High Court), shall

now lie before a Commercial Court (where constituted) exercising territorial

jurisdiction over such arbitration.

Consequent

amendments to CPC: The

provisions of the Code of Civil Procedure, 1908 (CPC), to the extent of its

application to any suit in respect of a Commercial Dispute of a specified

value, has been amended by the Ordinance to streamline the conduct of

Commercial Disputes. Key amendments to the CPC are as follows:

(a) The Ordinance has introduced a new provision in the CPC, which

prescribes that a Commercial Court or a Commercial Division will hold a ‘case

management hearing’ to frame issues and fix timelines, as noted below, to

ensure that the case is concluded in an expeditious and efficient manner.

(b) The amended provisions of the CPC allow parties to apply for

summary judgement where the court could arrive at a decision solely on the

basis of written pleadings.

(c) The ordinance has also introduced comprehensive provisions in

the CPC dealing with award of actual costs and interest. The amended provisions

of the CPC also provide the issues that Specialized Commercial Courts may

consider while imposing costs on parties. The earlier provisions under the CPC

dealing with costs and interest, provided for imposition of only nominal costs [3] (which

continue to apply to matters other than Commercial Disputes).

Fixed

Timelines: The Ordinance, while amending the provisions of the CPC, has also

introduced strict timelines to ensure prompt resolution of disputes, in the

following manner:

a) The maximum

period for filing a written statement has been set at 120 days upon the expiry

of which the defendant’s right to file a written statement shall stand

forfeited.

b) All appeals

to the Commercial Appellate Division must be made within a period of 60 days

from the date of the impugned judgement and the appellate division must

endeavour to dispose of the same within 6 months from when it is filed.

c) A plaintiff

seeking to adduce additional documents must make an application for the same

within 30 days of filing the suit.

d) All

applications seeking leave to deliver interrogatories must be decided within 7

days from the date on which they are filed.

e) Interrogatories

shall be answered by affidavit to be filed within 10 days, however such period

is extendable by the court.

f) All parties

must complete inspection of all documents disclosed within 30 days of the

filing of the written statement.

g) Any

directions sought by parties for inspection of documents must be disposed of

within 30 days of filing an application for such directions.

h) Inspection of

documents must be completed within 5 days of the passing of an order allowing

inspection.

i)

Parties must submit their statements of admission/denial of all

disclosed documents within 15 days of completion of the inspection. The court

however has the discretion to fix any other such time as it deems fit for

submission of these statements.

j)

Any party served with a notice to produce documents may be given

up to 15 days to submit the relevant documents.

k) The first

case management hearing is to be held within four weeks from the submission of

admission/denial of documents by all parties to the suit.

l)

Arguments must be concluded within 6 months from the date of the

first case management hearing

m) Written

arguments under distinct heads are to be submitted by the parties within 4

weeks of the commencement of oral arguments. Thereafter, the court may allow

revised written arguments to be filed within one week after conclusion of oral

arguments.

n) The court

must pronounce judgement within 90 days of conclusion of arguments.

The Commercial Court shall have jurisdiction to try all suits and

applications relating to a commercial dispute of a Specified Value arising out

of the entire territory of the State over which it has been vested territorial

jurisdiction.

Notwithstanding anything contained in any other law for the time

being in force, no civil revision application or petition shall be entertained

against any interlocutory order of a Commercial Court, including an order on

the issue of jurisdiction, and any such challenge, subject to the provisions of

section 13, shall be raised only in an appeal against the decree of the

Commercial Court.

Subscribe to:

Posts (Atom)