COLLECTIVE

FAILURE OF SYSTEM

The culture of ‘Self –enriching’,

growing rich at the cost of others, is fast catching up in India, courtesy the

politicians and the failure of systems to penalize them,thereby failing the

‘Doctrine of unjust enrichment’.

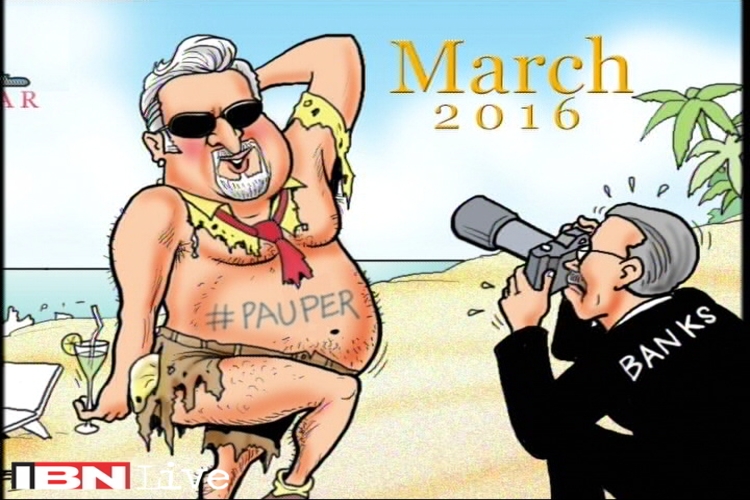

Mr Vijay Mallaya left the country, not set to return in the near

future, similar to Mr. Lalit Modi and the notorious Dawood Ibrahmin.

The systematic failure of the Banks

and the Regulatory system, in tandem with the blatant irresponsible use of the

Kingfisher conglomerate funds as the promoters personal money bank all

culminated into this massive blow up.

BANKS

a) The total amount that KFA owes to

all banks is approximately Rs. 9,000 Crores, broadly divided between the banks

as,SBI Rs. 1,600/- Crores, IDBIRs. 800/-Crores,PNB Rs. 800 Crores,BOI Rs. 650 Crores,BOB Rs.

550 Crores.

b) Consortium of 17 lenders led by SBI

had from time to time extended loans on favorable terms to KFA. Was Due

diligence properly conducted? Was credit appraisal properly done? With

individual risk of each bank being stretched by individual loans, a consortium

loan would further weaken the banks security and stretch the company’s asset

cover to its limits.

c) Every bank has a credit committee.Their

role in sanctioning huge amounts? As mentioned before, the banks had individual

credits extended to the company along with the consortium loan. This fact in

itself should have raised red flags within the banking system as it goes well

beyond the banks systematic risk.

d) Were they convinced to finance an

aircraft which they had never done in their life? Nor having knowledge of

financing aircrafts? A capital intensive industry in a competitive market built

on cash flows and working capital is massive risk in itself which requires

strenuous planning and sound crisis mitigation systems in place.

e)In the year 2009-10,the consortium

restructured their debt, even when KFA had negative net worth and was

technically categorized as an NPA. As a stakeholder, the banks should have

raised concerns and filed for creditors liquidation given the bad shape of the

company’s debts. However, restructuring the same debt was bound to fail, and

the banks had a moral duty to end the company then and there. Ignoring the

moral duty, they converted the loan into equity, that too at a premium. Rs. 1,355

Crores of debt was converted into equity at 61.6% premium of market price. In

lay man’s terms, a loan was converted into capital. Who benefited from this?

Certainly not any of the stakeholders!

f) A common element in all of the

lending’s was the reliance on the Kingfisher brand value and its (assumed)

ability to generate cash. How far can one take the reliance on ‘brand value’?

How reliable is the valuation itself. Given the bad shape of the debt in the

company and the conglomerate as a whole, shouldn’t the brand be revalued from

time to time to reflect its true value?

h) Inspite of all the aforementioned problems

the company was facing, Vijay Mallya drew a salary of almost Rs. 34 Crores. Was

there no shareholder activism or moral obligation on the any of the lenders and

Financial Institutional Investors to oppose this practice?

i) The auditors, of the Banks as well

as KFA, must have notices this bubble of loan bloating up for quite a while. In

a situation which escalated to non-payable debt of Rs. 9,000 Crores, none of

the auditors of any organizations which were a part of this transaction had

qualified any of the audit reports. Isn’t this a breach of the auditor’s

fiduciary duty?

Let us not forget that every company

here had to file its compliances regularly to regulators from every spectrum of

the economic industry. Which brings us to the next point.

REGULATORY

AUTHORITIES

The Enforcement

Directorate, RBI, Directorate of Aviation, the quasi-judicial body of DRT, the

Registrar of Companies, the Income tax authorities and ultimately the Stock

Exchange and SEBI. All of these regulatory bodies had received some form of

literature pertaining to KFA’s predicament, and yet, no suo moto action was taken. Some of the issues which these bodies

should have picked can reiterated, such as:

-

Conversion of 20%loan in to equity

when net worth was flattening.

-

Was prudential credit exposure limits

followed by banks?

-

The borrower’s inadequate credit

ratings and the Company’s eligibility. KFA’saviation license was cancelled in

the year 2012 and had not flown since then. How such a company which fails the

basic test of ‘going concern’ allowed to raise debt on a continuous basis.

-

The Labour commissioner did not take

any action in spite of salaries not paid on time.

CBI issued Look out Circular(LOC)against

Mallaya in October and changed it back in November. Why weren’t any reports

raised to question this action which was obviously on the right track? SFIO tightened

their grip on defaulting companies and the irresponsible lenders but only when

it was too late. Stakeholders expect a more pro-active intimidation from

regulatory authorities. Similarly, DRT has given adjournments a multitude of

times, which can be viewed as a failure of the judicial system. Did all the

aforementioned investigating agencies act with rectitude in the KFA case?

KFA

KFA was incorporated as a birthday

present to the son of Vijay Mallya, Siddharth Mallya, on his 18th

birthday, listing him as one of the Directors. At the inception, the airline

functioned in able hands actively killing the competition by setting up

benchmark of affordable luxury travel. However, it started going downhill soon

after. It started being used as the Mallya’s personal charter airline, which

primarily came into focus when he flew in pop star Enrique Iglesias for his 60th

Birthday, and started directing personal attacks on other airline by tweeting

about their poor service. Furthermore, the Basic principles of corporate governance

were not followed while running the company, let alone ethical standards.

He is drawing salary as Rajya Sabha Member(tax payers money) and he ran away from India on Diplomat passport.

This is not a one –off story.Such

stories get repeated with alarming regularity and yet every time the regulators

swoop in when the worst has passed. Jindal Steel & Power,Jai Prakash Associates

whose ratings have been downgraded by 2 notches in a single action, indicate

that they need to be monitored more closely.

No comments:

Post a Comment